Banking & Budgeting

Banking & Budgeting Tips & Technology For Your Tomorrow

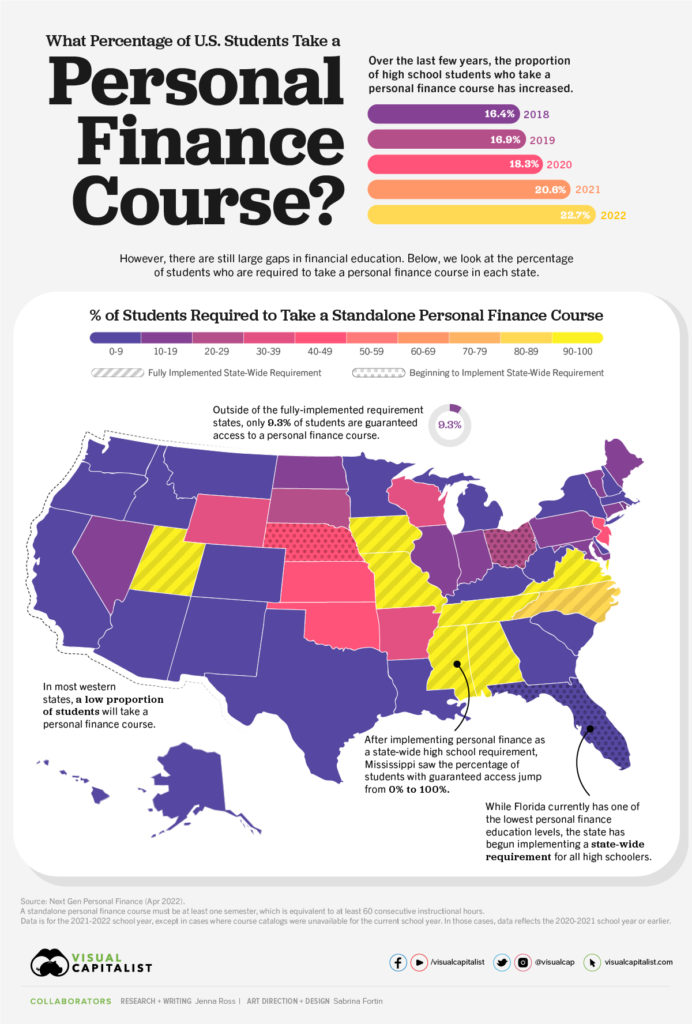

Look no further than your smartphone to find your new bank. The cost of a traditional bank has now become cost prohibitive. The same is now true for the traditional financial advisor who may not always have your best interest in mind. With the development of blockchain technology and Artificial Intelligence, the technology of today allows for better results for your financial future at a substantially lower cost.

Budgeting is one of those words that sounds overwhelming, confusing and boring but once you start you realize it is none of those things. In fact, a budget is proven to be the number one reason that people can eliminate their debt and never go back. Here you will find the latest tools, tips, and technology for using and budget and dealing with your debt.

Best budgeting apps for 2022: Are they worthy of managing money?

What should you do to increase savings? Not just for saving, paying multiple bills can be a nightmare when a lot of necessary spending comes in your way. People struggling with their numerous debts only wish to know how to simplify their debt. They often consider bill consolidation programs to repay your bills. But this …

Read moreBest budgeting apps for 2022: Are they worthy of managing money?

4 Options for a Great Career Without College Debt

College is expensive and growing costlier by the minute. As a result, more young adults are saying, “No thanks” to a four-year degree and finding more affordable ways to launch their careers. Instead of starting their adult life with nearly $30,000 in college debt, these financially savvy young adults are finding career paths that cost …

Read more4 Options for a Great Career Without College Debt

Simplify & Automate Your Finances

We have a habit of making our lives more complicated than they need to be. This includes our finances. The more I write the more I see how easy it can be to fall into the trap of complexity. This is especially true – although not always obvious – when it comes to our finances. …

Read moreSimplify & Automate Your Finances

How To Create A Budget

There are likely a number of reasons for why you may want to start a budget. Perhaps, you just graduated college, got a new job, getting married, having kids, looking to retire, or wanting to purchase a home. These and other major life events might be the trigger but they are only a few of …

Read moreHow To Create A Budget

Get Rid Of Your Debt With These 11 Proven Steps

Nobody wants to live life with debt even though approximately 80% of Americans carry some form of it. Debts are awful irrespective of type and amount. You can lose sleep at night all while being unable to secure your financial future. If you are in debt and want to become debt free on your own, then you should …

Read moreGet Rid Of Your Debt With These 11 Proven Steps