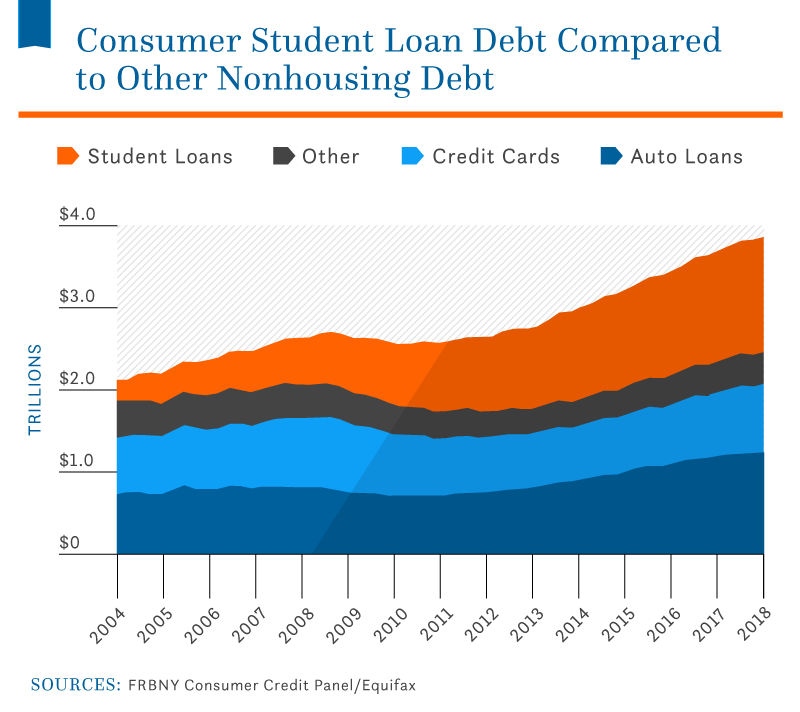

College tuition prices are rising exponentially each year and 44.7 million* Americans have student loan debt. The average monthly student loan payment is $393*. Student loan debt is by far the largest burden for most Americans today. With this in mind, saving for your child’s college education is one of the most important things you can do for their future. U-Nest is working to change this but before we talk about what U-Nest and what it can do for you let's take a look at some of the current college debt statistics as well as some of the ways you can save for college.

In order to maximize the money put away for your child’s education, there are a few options that are more beneficial than a standard savings account. The most common of these is a 529 plan, but UGMA/UTMA custodial accounts or a Coverdell ESA are also available. Keep in mind that these accounts were developed as a tax benefit for you to use as a tool in order to help incentivize you to save more for this growing burden.

529 Plan

A 529 plan is an investment account offering both tax-free earnings and withdrawals, given the money is used to pay for qualified educational expenses. Typically any expense involved in the enrollment of a student to a post-secondary education institution qualifies, such as tuition, room and board, and even computers. With a 529 account, you are able to change the beneficiary to another child or to yourself and the money never expires. The three primary advantages of a 529 are: the account grows tax-free, the parents retain control of the account, and there is minimal impact on financial aid award packages.

UGMA and UTMA Custodial Accounts

UGMA (Uniform Gift to Minors Act) and UTMA (Uniform Transfer to Minors Act) are custodial accounts used to hold and protect assets for minors until they reach a certain age in adulthood. Depending on the state, this could be when they turn 18. The account is considered the property of the minor, therefore a portion of the investment income is untaxed, while an equal portion is taxed at the child’s rate rather than the parents’. Money can be withdrawn without penalty for any expenses that benefit the child, not just educational ones. You can read more about the differences between a UGMA and UTMA account.

Coverdell ESA’s

Coverdell ESA’s (Education Savings Accounts) are similar to 529 plans in that they offer tax-free earnings and withdrawals given the money is spent on qualified educational expenses. Differing from a 529 plan, Coverdell ESA’s allow funds to be used for certain K-12 educational expenses. They are only available for families below a certain income level and have a much lower maximum contribution limit than a 529 plan. If you would like to learn about additional guidelines surrounding Coverdell accounts HERE is a good guideline and description.

The U-Nest 529

As you can tell from the options above – a 529 not only has the most flexibility it is also the most common when it comes to saving for college.

One of the best ways to open a 529 plan is with U-Nest. U-Nest is an app for iPhone and Android that makes opening a 529 plan easier than ever before. In just five minutes, you can open a 529 plan that has been selected from hundreds of financial institutions and State providers by financial experts at U-Nest. Within the app, you can set up monthly contributions and easily check the account balance at any time.

We interviewed the founder, Ksenia Yudina, who is a Chartered Financial Analyst and entrepreneur with over ten years of experience in the financial industry. In the interview, Ksenia stated that 70% of people don’t know a 529 exists, and only 14% of people are actually using one. U-Nest aims to solve this problem by making optimized 529 plans easily accessible to anyone, regardless of financial status.

U-Nest acts as a digital financial advisor and rebalances accounts over time to achieve a more conservative asset allocation as children get older. Unlike financial advisors that can cost upwards of $200 per hour, U-Nest has waived all underlying broker-dealer commissions, and the advisory fee is a simple and transparent $3 month. In addition, the minimum investment to open an account is just $25.

Visit the U-Next website to learn more about how you can get started.

*Source: www.studentloanhero.com