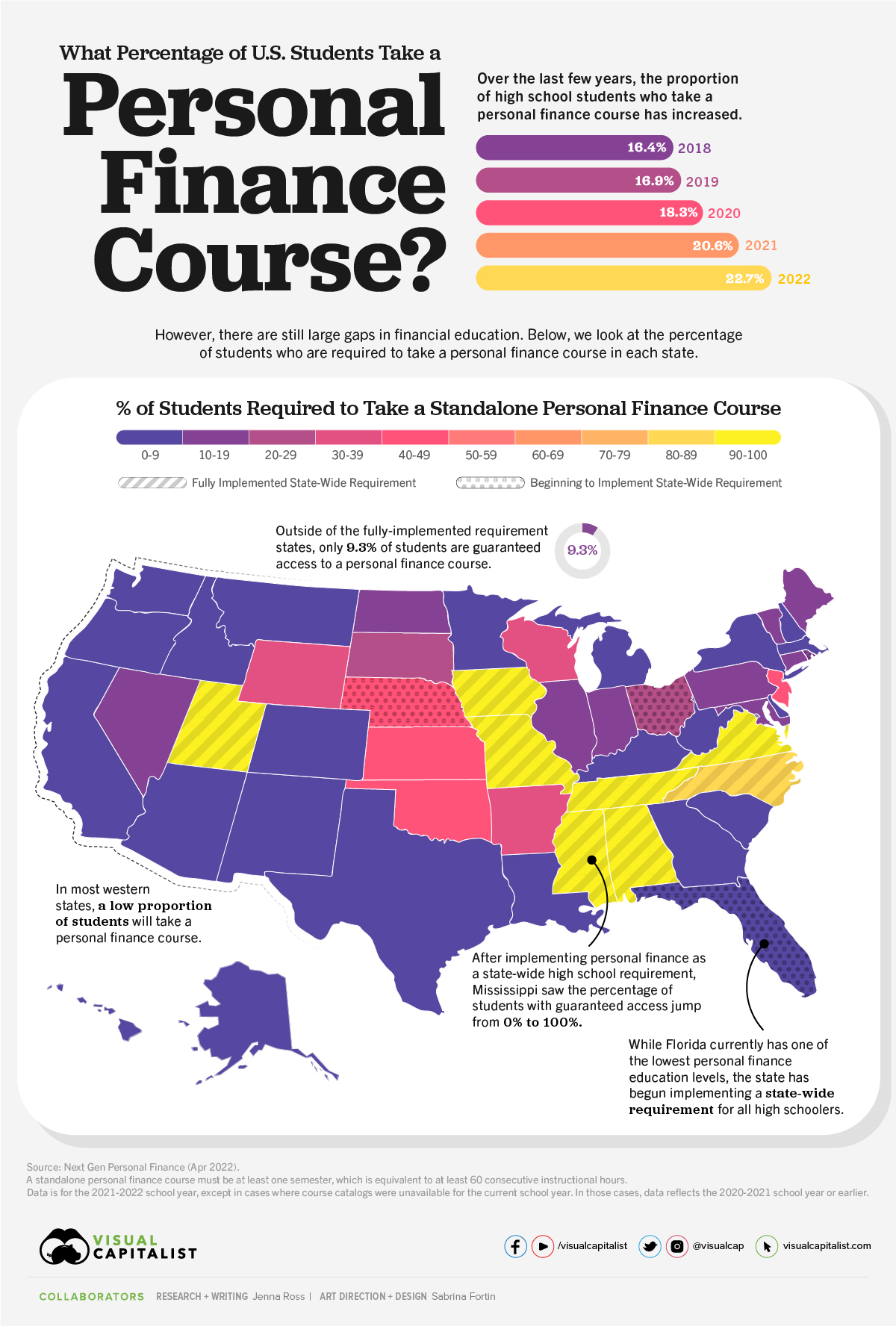

The Visual Capitalist put out this excellent graphic showing “What Percentage of U.S. Students Take a Personal Finance Course?”

fintech

Kalshi

Today, you can seemingly bet on anything thanks (or maybe no thanks) to the internet. One interesting new player in this space is Kalshi. Kalshi says it is a trading platform but really is a bet based on a real world event driven contract. For example, will it snow more than x inches in any given city on a certain date. These can be fun but with anything else in money…be cautions and balanced.

7 Proven Passive Income Ideas

This article discusses passive income investing options. FinTech Freedom is not responsible for investing loses or risks. Please see our disclosure statement.

Just the term “Passive Income” brings with it feelings of joy and excitement! Passive income generally involves either an investment in time or money. This post will highlight ways to generate passive income using money not time. Passive income where time is involved generally includes a side hustle often classified within the various opportunities found within the gig economy.

One of my favorite stories on investing money comes from Tim Ferris. Tim tells the story of how he created his own real-world MBA. In short, instead of going to Stanford business school to get his MBA he took what he would have spent on the MBA ($120,000) and invested it as an angel investor in $10-$50,000 increments.

Two important things to keep in mind. The first is to make sure that you only invest and put money into what you understand. Secondly, it often helps to invest in what interests you.

Among the various passive income ideas, these are the most popular and appear most frequently.

Stocks, Dividends, Bonds & Fixed Income

Build a Monthly Passive Dividend Paycheck with Dividend Stocks – WalletHacks

Owning equities such as stocks and bonds is one of the easiest and most efficient ways to generate passive income. This strategy requires the discipline to save and invest. We recommend using an index fund in the form of either a mutual fund or exchange-traded fund (ETF). Using an index fund allows you to get diversification at a very low cost as well as the simplicity of a couple of funds instead of a number of stocks. An S&P 500 index fund, as well as a broad-based bond fund composed of government, corporate and municipal bonds in addition to an Index real estate investment trust (REIT), represent three great areas to start which brings broad diversification.

Peer to Peer Lending

How I Earn Over 10% Passive Income With P2P Lending – Financial Samurai

Prior to the exponential growth of the internet, it was impossible for anyone looking for a loan to receive a loan unless they had access to or a relationship with a bank. Thankfully, this is no longer the case! Today, online peer to peer lending allows almost anyone access to a loan. Not only does this allow for greater access but it is also cheaper for borrowers given the greater level of competition with banks as well as other online outlets. On the flip side – online borrowing with peer to peer loans gives investors the opportunity to passively earn a return on their investment. Borrowers involved in peer to peer lending can experience a lower interest rate than they would from a bank while investors experience a greater return on their money than if that money were to sit in a bank account. The result? A win-win with higher earning potential for lenders and lower borrowing costs for borrowers.

An important note, with the current record level of consumer debt you may want to tread lightly here. Or – at the very least – make sure that your investments are well diversified from risky to less risky. Two of the largest peer to peer lending platforms are Lending Club and Prosper. Nerdwallet has a great comparison chart outlining the pros and cons of both platforms.

As an example to show the opportunity for both borrower and lender, say the borrower wants to borrow $5,000 to remodel their kitchen. Peer to peer lending allows the borrower to get a loan for 6% vs. 8% from the bank. The lender gets a return of 4% vs. 2% for keeping their money in a bank. Before peer to peer lending the bank would be able to keep a profit of 6% (8% minus 2%) Peer to peer lending enables the borrower to save 2% and the lender gets a 2% larger return on their money. Consequently, both borrower and lender come out in a better position with peer to peer lending than if they would have used a traditional middleman (bank)!

Small Business Lending & Investing

Small business investing and lending can be lucrative and act as another creative way to diversify your investments. It also carries risk just as any other investment does. In most cases, you are lending to help fulfill inventory requirements against a purchase order. Platforms in this space include Funding Circle, KickFurther, Street Shares, and Kabbage.

Real Estate Crowdfunding

Real Estate Crowdfunding – Financial Samurai

Real estate crowdfunding is a relatively new entry to the passive income market! Real estate crowdfunding investors can invest small amounts of money in real estate property anywhere without the hassle of having to deal with the headaches that come along with being a landlord. There are now dozens of online platforms that allow you to become a direct investor in specific real estate projects. Two of the most comprehensive crowdfunding comparison resources I have found online is over at investorjunkie.com and FitSmallBusiness.

Another way to gain exposure to real estate and earn passive income is with a REIT.

Rent Your Stuff

13 Ways to Make Extra Cash Renting Out Your Stuff – Part-Time Money

20 Things You Can Rent Out For Extra Money – Vital Dollar

Today, you can rent out almost anything that you own. Large ticket items such as real estate and vehicles can be rented out on places such as Airbnb and Turo. Beyond large ticket items, it is now possible to rent out almost anything you may have just lying around!

Solar Energy

When Ms. Cafe Career Coach and I begin to build our dream home we can’t wait to slap on the amazing Tesla Solar Roof! Until then, one way to earn money from solar is to invest in it! With Wunder Capital, you can do just that!

Find Your Missing Money

An additional possible passive income source that is worth checking out is to try and find missing money using either Unclaimed.org and MissingMoney.com.

One popular way to make money somewhat passively is online. We wanted to include a couple of articles on how best to make money online even though these ideas primarily fall into the category of a time commitment side hustle. Over time it is possible for the time commitment required to evolve into a significant passive income which is why we decided to include the following articles to get you started.

How To Make Money Online: 34 Ways You Can Start Earning Today

17 Ways To Earn Extra Money Online This Month

How to Make Money Online: 21 Ways to Make Money From Your Laptop

Other great articles on passive income can be found over at: MoneyPeach, Club Thrifty, Vital Dollar, Well Kept Wallet, Millennial Money, Making Momentum and a personal favorite from Financial Samurai.

Bonus: Wrap Your Car In An Advertisement

With companies like Wrapify, Carvertise, and Free Car Media you can have a company pay you to place an ad on your car.

Passive Income Is Possible

Never before has it been this easy to achieve passive income to invest and earn money online. Thanks to new fintech companies that are springing up there are many to choose from!

Fintech Freedom’s June 2019 Top Posts

Happy 4th of July! Here are some of the best personal finance and fintech posts from June 2019.

Podcasts

Bishop Barron: Catholicism and the Modern Age – Jordan Peterson Podcast

While not a personal finance or fintech related post I highly recommend this podcast discussion between Jordan Peterson and Bishop Robert Barron. While your personal finances and overall financial well being are important I think it is important to remain focused on what is truly most important in life. As a Catholic, I have enjoyed listening and reading the work of Bishop Barron. This podcast brings together the very best of Catholicism, philosophy, and psychology from two beautiful minds. This is one you will want to listen to at least twice!

Naval Ravikant – Joe Rogan Podcast

Another classic podcast with Naval Ravikant who is another great thinker of our time. This podcast covers a lot of ground on various topics and will undoubtedly be one you will want to listen to over and over again!

Credit & Debt

I've Paid $18,000 To A $24,000 Student Loan, & I Still Owe $24,000 – Bustle

The student loan problem we now have in this country might not feel like a crisis but it is for 44.2 million Americans! What makes the student loan crisis not as prevalent as the 2008 financial crisis has more to do with the fact that college-educated students have a lifetime to pay back their student loans and as long as the federal government continues to back these loans the cost of education will only continue to rise while the threat of frozen financial markets like we witnessed in 2008 remains mute. I predict that we will only see the cost of college go down when the federal government stops guaranteeing these loans. Until then, the banks, financial institutions, and universities will only continue to profit from them. It’s hard to stop lending (gambling) when the risk of actually losing (gambling) stands at 0 percent. When politicians say they will wipe clean student loans the cost for these borrowers only rise because when they stop paying thinking they will get relief the interest and principal balance will simply continue to grow. Plus, how are the millions of borrowers who paid back their loans in full going to feel? This is a difficult situation only getting worse but with a few simple obvious adjustments could improve.

Insurance

How to Buy Life Insurance – Credit Donkey

A comprehensive resource for purchasing life insurance! If you don’t currently have life insurance and someone else is dependent on your income be sure to make purchasing a term life insurance policy a priority.

Investing

VTI vs. VTSAX: What’s The Difference – Four Pillar Freedom

If it isn’t already obvious why investing in Index Funds and ETFs are a better strategy than trying to pick individual stocks or an investment advisor let this be the article which saves you the time, energy and stress of having to deal with an advisor who might be claiming they know best and can beat the average. This article will show you why being average in investing is precisely what you want to achieve! Here is one on VTI vs VOO. You will quickly see that the same principle applies!

Why I Love The Roth IRA – The Free Financial Advisor

If you don’t already have a Roth IRA open let this article be your reason you open one in the next 5 minutes! Our Roth IRAs we max on or as close to January 1st each and every year! Hopefully, after reading this article you will do the same!

Real Estate

Zillow’s 2018 Consumer Housing Trends Report – Zillow

Check out this comprehensive consumer housing report from Zillow which has nearly any and every consumer housing statistic you could ever want or think of!

Saving

Interest Rate Chasing in Your Savings Account – A Wealth Of Common Sense

“There is over $8 TRILLION sitting in savings accounts at banks that are earning an average yield of 0.10%, which is ludicrous. These people should move their money to an online savings account pronto.” As interest rates rise make sure your cash is working for you every minute of every day even when you sleep!

Miscellaneous Links I Liked

Financial Advice For My New Daughter – Collaborative Fund

We are expecting our first daughter in August! As a first-time father, I admit that I am a bit nervous but also excited! Excited for the many obvious reasons nervous for many more! This article is exactly the one I plan to share with her 10 years from today!

12 Major Decisions and How We Feel About Them Now – Budgets Are Sexy

Great post from J. Money on some past decisions he has made. This one might seem personal and on the surface not interesting for a larger audience but you will see that almost anyone can get some valuable insight and value from it! Including, why the first $100,000 is always the most difficult and why and how it gets so much easier after you reach this important milestone!

For a look at other amazing content from the personal finance, community take a look at Rockstar Finance.

To see previous months top picks click here.

5 Top Fintech Resources For 2019

It was the summer of 2017 when I started to think about creating a website where I could share what seemed to be an enormous amount of data on consumer and personal finances. As a technical consultant, with a background in and passion for finance, it became clear to me that a resource that breaks down and applies this information effectively for the consumer was/is needed. It's been exciting to see over the past 2-3 years the tremendous growth of the financial tech (fintech) industry and the amount of new fintech resources that are now available to the consumer.

However, even with this good news, the big question remained for me – will consumers be able to take advantage of these new fintech resources once reserved for a select few? Thus far, the data shows they have not. With personal debt levels at new highs combined with 78% of full-time workers living paycheck to paycheck, I knew that if I could help bridge the gap from where to find these fintech resources to this new technology to consumers then this website and the work I put into it would be well worth it! So let's get started!

Fintech Is Our Future

One of the things that used to frustrate me while I was working in the finance world was that it was always those that had the most that everyone in the industry wanted to help. And when I say the most I’m not only talking about money and resources but also the information, background, and education. It seemed as though the only way you could make money was either by having it or helping and advising those that already have the resources. And yes, our primary and secondary education in many ways have not provided financial planning anywhere in their curriculum. As we look on into the future – thanks to the innovation brought forth to all of us because of the incredible advances we have seen in technology – it is bright. Because of this – Fintech Is Our Future!

The 2018 Top 5 FinTech Resources

A big reason I decided to start fintech freedom is to be able to show to anyone who is struggling with managing their personal finances that there is an amazing community of fintech companies that they can rely on to help them. However, when I began my quest to learn everything I could about the companies working in the fintech personal finance space I quickly realized that the information can be both overwhelming and confusing. This is just one of the reasons that I have outlined this website into 11 broad categories. As I generate more content on this website – one of my goals is to eventually land on a clear step-by-step approach where you as a reader can follow along no matter what phase of the financial planning cycle you are currently in. Until then, here are some of the avenues that I use online.

Product Hunt

Product Hunt is an incredible resource for all things tech related. The site was recently acquired by another great resource – AngelList – which has only continued to make the site even better. Ryan Hoover and his team have done a great job leading Product Hunt to be one of the first places I visit every day to see new and exciting products. The Fintech related Product Hunt lists include the Product Hunt Fintech Topic list. The list description reads “At some point, we all have to pay bills, save money and pay our taxes. Here are a few things to help manage finances before your cash flies away.” I couldn’t have said it better myself! Another Product Hunt list I often visit is the Investing topic. Product Hunt has built in a number of search elements. There truly is something for everyone at Product Hunt.

BetaList

The first text you see when you visit Betalist is “Discover tomorrow's startups, today.” You have the option to sort through literally hundreds of different industries to see the startups of tomorrow. Naturally, I have bookmarked the Financial Technology Betalist but feel free to search for whatever you are interested in.

Y Combinator

Y Combinator is one of the most known seed investment accelerators out there! Started in 2005, Y Combinator has invested in nearly 1,600 startups. Nearly 100 of these are classified under the Y Combinator Fintech vertical.

FinTechStartups.co

FinTechStartups.co is an incredible aggregator of fintech startups across the World covering a wide range of financial categories. They also provide a monthly report detailing fintech activities that have taken place Worldwide during the course of the previous month.

RockStar Finance

Rockstar finance is the spot for all personal finance blogs! Even though the site isn’t specifically devoted to fintech the site has a directory all of the best personal finance blogs. If you’re interested in personal finance this is the place to check out! I just recently added fintech freedom to the directory.

The Resources & Content Is Out There!

The growth in content and fintech resources online have been exponential in the last couple of years. While this can certainly be positive it also can have the opposite effect for many who can easily become overwhelmed by the sheer amount of information. There are those that can suffer from almost a “paralysis by analysis” and others who just sit on their hands and do nothing to help themselves because of the overwhelming amount of information now available. Here, at fintech freedom it is my goal to put together a clear path – call it a step-by-step financial checklist which will be coming soon and will be added to over time. This checklist will give you a clear path to using the fintech resource tools and technology that can most benefit you and blocking out the rest.