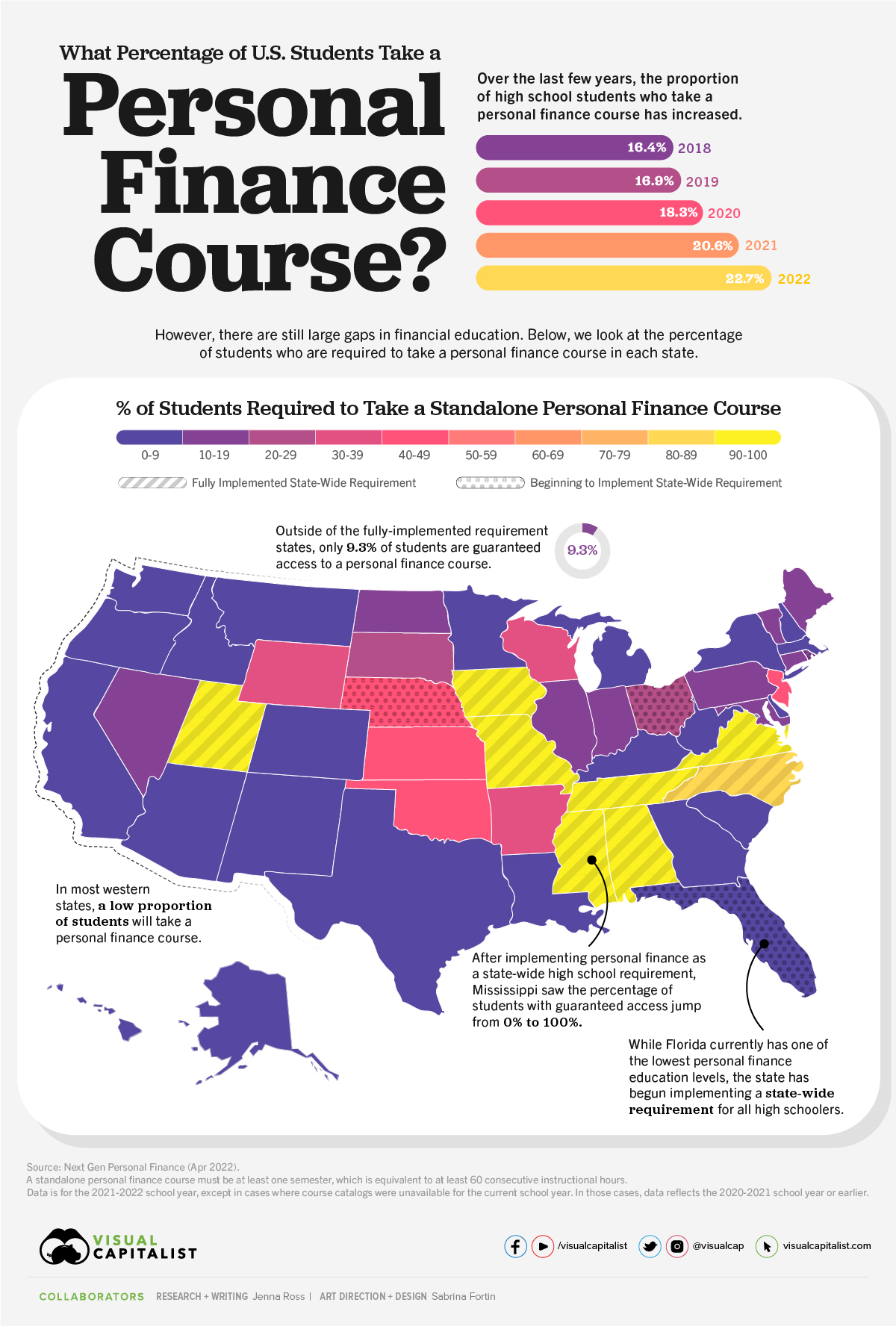

The Visual Capitalist put out this excellent graphic showing “What Percentage of U.S. Students Take a Personal Finance Course?”

Budgeting & Debt

See how to budget and take on your debt using the latest fintech technology. A budget is the number one reason people eliminate their debt and never go back. Here you will find the latest tools, tips, and technology for creating a budget and dealing with your debt.

Best budgeting apps for 2022: Are they worthy of managing money?

What should you do to increase savings? Not just for saving, paying multiple bills can be a nightmare when a lot of necessary spending comes in your way. People struggling with their numerous debts only wish to know how to simplify their debt. They often consider bill consolidation programs to repay your bills. But this kind of professional help comes with a charge or a fee. A simple solution is available. You can use budgeting apps for managing bills and saving money. Many budgeting apps are available for free.

Mint, ranked as the best free budgeting app, is a good option. Free apps usually have limited features.

You may need to pay a specific fee for a budget app with premium features.

Read the article to know about budgeting apps in detail.

Budgeting apps: are they really useful?

The primary goal of budgeting apps is to provide you control over your finances while still being convenient and straightforward. Every budgeting app is different, but they all operate to help you manage your money in the same way. Budgeting apps can connect to your bank and credit card accounts, allowing you to keep track of your spending and manage your finances from anywhere. The primary purpose of these financial apps is to assist you in creating a manageable budget based on your regular income and spending. Some programs, such as the zero-based budget, take a unique approach to budget. Others take a broader approach, allowing you to set up numerous budget categories and allocate money from your paychecks to them. Budgeting apps linked to your checking or credit card accounts can automatically track new purchases and other debit activities for you.

You might be able to utilize budgeting software to pay bills on autopilot each month, similar to the automated bill payment feature your checking account or credit card may offer. Due date trackers are another feature available in budgeting apps that can help you avoid late or missed bill payments.

| Top Budgeting apps | Features | Pros | Cons |

| Mint | 1. Easy to use Interface 2. You can automatically classify your expenses. It helps in making graphs or charts. 3. Sign in with your fingerprint to keep all of your information safe and secure. 4. Allows customers to link bank accounts and obtain free credit reports. 5. The software allows you to check your credit score. | 1. Expenses are simple to categorize. 2. You can get real-time spending reports. 3. Monthly bills are simple to keep track of. 4. Make a spending budget for the month. 5. You can set spending alerts | 1. Advertisements create a delay 2. While synchronizing accounts, you can face difficulties. 3. Multiple currencies aren't included in the system. 4. Multiple savings objectives cannot be assigned to a single account. |

| YNAB | 1. Goal-setting function. 2. Users can better understand their purchasing habits with detailed visual data. 3. Users can establish goals and see how long it will take them to attain them. 4. Users will be able to deal with flexible budgeting. | 1. It's simple to double-check your financial facts. 2. Several banks and different devices are supported. Spending is simple to keep track of. 3. Spending categories that can be customized | 1. You can't track your investments. 2. Limited free offer. 3. Customer service is solely available via email. 4. There are no features for keeping track of bills. |

| Goodbudget | 1. Syncs automatically between Android, iPhone, and the web 2. Add bank accounts and transfer money fast. 3. It allows you to exchange info with loved ones. 4. For emergency finances, make changes to your budget as needed. | 1. Easy to use. 2. Synchronizes to all devices 3. Can transfer funds from another envelope to cover the additional expense 4. Examine detailed spending reports. | 1. Limited free offers 2. It does not sync with bank accounts. 3. Can't keep track of your investments |

| Personal Capital | 1. It has a cash flow analyzer system 2. It helps track your income and expenses across several accounts. 3. It has a retirement planner feature 4. It helps calculate your net worth. | 1. It assists you in determining your retirement objectives. 2. Tracking of your assets and liabilities. 3. It's simple to get in touch with personal advisors for any financial assistance. 4. Individual securities can be purchased. 5. Tools for managing investment are free. 6. Financial advisors can provide you with skilled assistance. 7. Tax optimization strategy available. | 1. You should have a minimum of $100,000 in your account. 2. You need to spend management fees. |

A few points to note while using a budgeting app

If you want to use a budgeting app. follow these guidelines to get the most out of them:

● Before you download any budgeting app, think about what you want to get out of it. This can assist you in setting reasonable expectations for how you will use the app.

● Don't give up on budgeting entirely if you find that a budgeting tool isn't working for you. A budgeting software tool or a budgeting spreadsheet may be a better fit for you. Whatever method you use to budget, the most important thing is to pick one that works for you and stick to it.

● Compare the features and benefits of different apps. This can save you money by preventing a budgeting approach mismatch or paying for costly software with features you won't use.

● If you don't check in with your money regularly, a budgeting tool can not help you save money. So make it a habit to check-in at least once a week, if not every day, to see how you're doing.

● Set your goals like stop blowing your income or paying off your debt. Beyond using a budgeting tool, this can help you gain perspective on what else you might need to modify.

● Know the fees you are paying for a budgeting app. Using a budget app spending a lot doesn't make sense if your goal is to save money.

Budgeting apps remain a popular money management choice for consumers who wish to feel more in charge of their spending.

Knowing the best budgeting apps can do wonders for you. Selecting an app that fits your spending style and overall financial position is the first step toward successfully using them.

Select examined and compared over a dozen budgeting apps, exploring their cost and features to decide the best overall. We have recommended simple-to-use apps here.

AUTHOR BIO:

Lyle Solomon has extensive legal experience as well as in-depth knowledge and experience in consumer finance and writing. He has been a member of the California State Bar since 2003. He graduated from the University of the Pacific's McGeorge School of Law in Sacramento, California, in 1998, and currently works for the Oak View Law Group in California as a principal attorney.

US 10-Year Treasury Yield

US 10-Year Treasury Yield…

July 1980: 10.1%

July 1985: 10.5%

July 1990: 8.5%

July 1995: 6.5%

July 2000: 6.0%

July 2005: 4.3%

July 2010: 3.0%

July 2015: 2.3%

July 2020: 0.6%

— Charlie Bilello (@charliebilello) July 23, 2020

4 Options for a Great Career Without College Debt

College is expensive and growing costlier by the minute. As a result, more young adults are saying, “No thanks” to a four-year degree and finding more affordable ways to launch their careers. Instead of starting their adult life with nearly $30,000 in college debt, these financially savvy young adults are finding career paths that cost less to enter and offer a faster return on investment.

Are you questioning whether college is right for you? Before spending thousands of dollars on a degree you’re not sure about, consider one of these alternative career paths instead.

Join the Trades

New college grads may earn more than newly employed blue-collar workers, but within ten years, tradespeople with at least a one-year certificate earn nearly as much as workers with four-year degrees. Not only that, but people who enter the trades start earning an income sooner and take on less debt at the start of their career. The average trade school degree costs $33,000 (in some cases, all you need is an apprenticeship). Meanwhile, a four-year degree from a public university costs $9,970 on average, and attending a private or out-of-state public university can be even more costly.

Work in the Gig Economy

When most people think of the gig economy, they think of side gigs like driving a rideshare or walking dogs. However, the gig economy encompasses far more than these part-time jobs. Designers, developers, handymen, IT technicians, caregivers, chefs, and more can find clients and earn high hourly rates. Popular gig economy apps have made it easier than ever to hire self-employed professionals. While working in the gig economy can be riskier than securing a full-time job, it’s a good fit for go-getters who value the freedom and flexibility to work wherever, whenever.

Enter Public Service

High student loan debt paired with low wages in the non-profit and public sectors makes it challenging for college graduates to afford a career in public service. While it’s possible to receive loan forgiveness in exchange for your public service, you have to make payments for 10 years before you can qualify. Even then, you might be denied.

If you want to give back, there’s another way. High school graduates can join AmeriCorps, a national service program designed for young people. Unlike Peace Corps, most AmeriCorps programs don’t require a college degree to join. While AmeriCorps positions are time limited, graduates can use the professional experience they gain to advance their careers. AmeriCorps VISTA members also receive non-competitive eligibility for federal jobs following their service.

Join the Military

Whether you join the military for a few years to reap the GI bill benefits or stick it out until retirement, military service can be a smart way to start your career. There are drawbacks, of course, like the risk of deployment and not having control over where you’re stationed. However, for many young adults, that’s a fair tradeoff for a stable income, great benefits, and on-the-job training.

If you don’t expect to stay in the service for the long run, choose a military career that readily translates to the civilian workforce. Listing your infantry job on a resume might not get you far in the civilian world, but including your military service in health science, cybersecurity, or human services may.

If you’re interested in a career path that requires a bachelor’s degree or higher, college is likely the right choice for you. Even then, it’s important to research job growth and salaries to make sure you’ll be able to pay off your student loans and afford a good quality of life.

For everyone else? If you’re not confident college is for you, don’t go into debt just because it seems like the thing to do. There are a lot of ways to earn a great living without college, and if you do decide you need a degree, you can always go back to school in the future.

The article above is a guest post from Brittany Fisher over at Financially Well.

Simplify & Automate Your Finances

We have a habit of making our lives more complicated than they need to be. This includes our finances. The more I write the more I see how easy it can be to fall into the trap of complexity. This is especially true – although not always obvious – when it comes to our finances.

The following is a list of simple things you can do to simplify and automate your finances.

- Reduce the number of credit cards you have down to as a few as possible. Ideally, your goal should be zero credit cards but if this isn't an option try to get to just have one credit card (If you own a business make sure you have a separate credit card for the business that you are not using for personal expenses.) The advantage of having either zero or one credit card is you can track your spending.

- If you are using a credit card be sure to set up alerts in your account (either push or email) to notify you of any spending over $1 on your account. This will prevent any fraudulent spending and help you keep a good handle on what you are spending money on!

- Setup an automatic full balance payment of your credit card from your bank so that your credit card is paid off in full each and every month in order to avoid any fees or penalty charges.

- Move any cash sitting in a core cash account into a money market account for a greater interest rate return.

- Stop all paper statements and set up email or digital statements for everything. In today's age, there is no reason to receive paper statements when everything you need is online!

- Setup automatic payments for all of your bills so that nothing gets overlooked!

- Create a budget to track all of your spending! Once you have a budget in place set a calendar reminder for the 1st of each month to take 20 minutes to review your budget.

- After a few months of budgeting take the time to go through each line item of your budget and either reduce or eliminate any additional services you are not using. The most common are subscriptions that often go unused.

- Use just one bank for your checking and savings account needs.

- Use just one brokerage account for your retirement accounts and investing. Note: Most brokerage accounts such as Fidelity and Schwab can also handle all of your banking needs but there are certainly times when you might also want a local bank as was referenced in the previous item.

- If possible, have all of your insurance policies with one reputable insurance company. Stop for a second and consider all of the insurance policies that you likely currently have in places. Examples include car insurance, home or renters insurance, jewelry insurance, identity theft insurance, long term care insurance, health insurance, life insurance & this list could go on! It is unlikely that one company covers all of this (for example health, long term care, and life insurance are often separate insurance carriers) but it is important to check since some companies will offer a discount when you combine coverages. For example, we use USAA for most of our insurance needs but our health and life insurance are elsewhere.

- Set a schedule to check your credit report once every 4 months by rotating between the three major credit reporting agencies (Experian, Equifax, and Transunion) each time.

- Have an estate plan in place.

How To Create A Budget

There are likely a number of reasons for why you may want to start a budget. Perhaps, you just graduated college, got a new job, getting married, having kids, looking to retire, or wanting to purchase a home. These and other major life events might be the trigger but they are only a few of the many reasons you must have an ongoing monthly budget in place!

A budget will put you in a better position for retirement, give you more peace of mind, and enable you to do more than the 78% of consumers working full time that are unfortunately living paycheck to paycheck.

Here are the simple steps to make a budget!

- First, sign-up for a Personal Capital account. Once you have created a Personal Capital account link all of your financial accounts to it. These accounts would include items such as your banks, credit cards, and brokerage accounts. Once you have linked all of your accounts you will see a budgeting section in the middle of your dashboard. Click on the budget section and categorize each expense for the past month. This will then create a pie chart and line chart showing each category spending for the month as well as a line item chart showing how your spending compares to the previous month.

- Once you have everything categorized save a copy of this Google spreadsheet to your Google Drive account. Important note: Do not edit this copy since it is a publicly available spreadsheet. Instead, save a copy for yourself that you can edit with your own data. This spreadsheet you will edit once a month using the data from your Personal Capital account.

- You might be asking. Why do I need to use this spreadsheet if I use the Personal Capital budget feature? A few reasons:

- I think it's important to do some manual entry (should take no more than 10-15 minutes) once per month so you have a sense of what you are truly spending. Yes, having technology like Personal Capital do a lot of the work for you is great but using the spreadsheet gives you an excuse to look at on your own or with your partner. Also, the spreadsheet will give you your average monthly spend which (so far) Personal Capital does not. And, it breaks down your essential and discretionary spending by amount and percentage. So, you can see if you are spending more on discretionary spending and saving less. I am sure Personal Capital will eventually get around to implementing these data points using your raw spending data. Until then, use this spreadsheet in conjunction with your Personal Capital account.

The Top Budgeting Resources

With budgeting, I realize that there is no such thing as a one size fits all approach. Therefore, I would invariably lose some readers. So, I have collected some other popular budgeting articles below. With budgeting, the trick is finding what you like and sticking to it!

Budget Templates, Tools, and Sites

- Budgets Are Sexy outlines templates and sites for creating and using a budget.

- NerdWallet outlines the best budget apps. Two popular budget apps are: Mint and EveryDollar

- MoneyUnder30 8 apps that help you build your net worth and includes some of the top budgeting tools online today.

See more budgeting and debt posts.

Get Rid Of Your Debt With These 11 Proven Steps

Nobody wants to live life with debt even though approximately 80% of Americans carry some form of it. Debts are awful irrespective of type and amount. You can lose sleep at night all while being unable to secure your financial future. If you are in debt and want to become debt free on your own, then you should know the best ways to do it.

These 11 proven steps can help you to become debt free.

1. List your debts and assess your income

At first, you need to arrange your debts with their balance and interest rate. After that, analyze your total income to decide how much you can afford to make debt payments. To eliminate debt, you need to calculate the monthly payments that are required to pay off your debts. Use a debt payment calculator. It will help you decide whether or not you can afford the debt payments. If you can’t afford the monthly debt payments, then you should work on saving money first to pay off your debts on your own. Otherwise, you may have to consider professional debt relief

2. Follow the debt avalanche method

Remember, the highest interest rate debt is costing you more money. So, try to pay off the debt which has a higher interest rate. By following the debt avalanche method you can get rid of those highest interest rate pesky debts. You need to arrange the debts from the highest interest rate to the lowest interest rate. Start making larger payments to the highest interest rate debt while paying the minimum to the others. Once you pay off the highest one, target the second highest interest rate debt. Follow the same rule until all the debts get paid of.

See the chart-1 below ( 4 credit cards with different interest rate and outstanding balance)

Chart-1

| Account Name | Outstanding Balance | Interest Rate |

| Credit Card – A | $20,000 | 12.31% |

| Credit Card – B | $5,000 | 8.50% |

| Credit Card – C | $3,000 | 5.01% |

| Credit Card – D | $15,000 | 4.50% |

In the debt avalanche method, you need to target credit card A first since it has the highest interest rate (12.31%). You need to make large payments or extra payments while paying the minimum to the other credit card debts. Once you pay off credit card A follow the same method until you pay off all the debts.

3. Follow the debt snowball method

The Debt-snowball method works best if you have a low income or minimal cash flow. In this method, you need to arrange your debts from smallest to largest irrespective of their interest rates.

See the chart-2 below ( 4 credit cards with different interest rate and outstanding balance)

| Account Name | Outstanding Balance | Interest Rate |

| Credit Card – C | $3,000 | 5.01% |

| Credit Card – B | $5,000 | 8.50% |

| Credit Card – D | $15,000 | 4.50% |

| Credit Card – A | $20,000 | 12.31% |

Make larger payments to the smallest debt Credit card – C while paying the minimum balance on the other debts. Once you pay off C follow the same method until you pay off all the debts.

4. Take out a consolidation loan to pay off your multiple debts

If you are unable to manage your multiple debts, then you can take out a consolidation loan at a lower interest rate to repay debts you owe. It helps to simplify your debt payments. You just need to pay back this single loan within the stipulated time. Make sure you make the monthly debt payments on the new consolidation loan. There are a number of great new personal loan companies to choose from.

5. Consider balance transfer method to pay off your credit card debts

A balance transfer can help you to pay off multiple credit card debts. It allows you to transfer high-interest debts to a low-interest card with the available credit limit. You can also take out a balance transfer card with zero or a very low interest rate. Repay the balance within the promotional period before the interest rate increases.

6. Settle your debts on your own

If you think that you can’t pay off the entire debt load but you are able to pay off half of the debts you owe, then debt settlement can be a good option. The good part is, you can settle your debts on your own. You just need to convince your creditors or debt collectors about it. You can request them for the settlement by explaining your financial hardship. Tell them that you can’t afford the full debt payments and ask if they would accept a reduced amount of debt.

7. Follow a frugal budget

Most people think that a frugal budget is nothing but depriving yourself, which is not true. Living a frugal life is nothing but spending your hard-earned bucks on the necessities. So, learn to differentiate between ‘wants’ and ‘needs’ to prioritize your expenses. A budget will help you track your monthly income and expenditure. Thus, you can monitor your savings and determine how much you can set aside for debt payments. Review the budget at the end of the month so that you can make changes wherever necessary.

8. Save money aggressively

Try to save more so that you can make extra payments within either the debt avalanche or snowball method. Spend less than what you earn in a month so that you can lead a life that is within your means. Cut down unnecessary expenses so that you can set aside more money to repay debts.

9. Reduce the usage of your credit cards

Curb the usage of your credit cards to stop accumulating further debt. Carry cash instead of credit so that you can easily avoid the risk of falling into high-interest debt. Remember, credit cards are not free money. You have to make the bills in full and on time. Otherwise, you will fall into credit card debt. Most importantly, while you are trying to become debt free on your own, you should try to avoid accumulating unnecessary monthly bills.

10. Build an emergency fund to avoid further debts

Try not to accumulate new debts. After paying off your current debts, try to save enough to build an emergency fund to manage sudden financial emergencies. Save at least 10% of what you earn in a month so that you can at least have enough money with which you can manage an emergency. Avoid taking out a loan or using credit cards to manage an emergency. Using your emergency fund helps to avoid further debt in the future.

11. Monitor your credit and identity

While working on your debt it is important to monitor your credit and avoid becoming a victim of identity theft.

Cut down on all the financial habits right now! Remember, living an extravagant life using credit cards is not recommended especially when you're trying to become debt free.

Also, be patient, getting out of the debt is not impossible – but the whole process can take time.

So, work hard on your debt repayment goal to get rid of the debts as soon as possible.

This article was a guest post from Patricia Sanders. Patricia Sanders is a financial content writer. She has been praised for her effective financial tips that can be followed easily. Her passion for helping people who are stuck in financial problems has earned her recognition and honor in the industry. Besides writing, she loves to travel and read various books.